Financing options for solar projects can be complicated, and that is particularly true for commercial and industrial (C&I) solar projects. Yet understanding the available financing tools is essential for solar contractors operating in this space. After all, determining how to pay for a solar project of this size is a critical first step to getting the project off the ground.

In this article, Part 4 of our Unlocking Commercial Solar series, we provide an introduction to some of the common commercial solar financing options—including considerations for determining which may make sense in different instances. While the complexity of these financing mechanisms means that a deep exploration of each is beyond the scope of this article, we’ll get you familiar with the basics and include links to other sources where you can learn more.(Looking for a more introductory overview of solar finance for both residential and commercial projects? Check out our Solar Finance Primer!)

We spoke with practitioners in the field to get real-world perspectives on these commercial solar financing mechanisms and what you should know about them. We talked with Dan Holloway, VP Origination & Acquisitions at Sustainable Capital Finance, a financier that provides commercial solar PPAs, and Conrad Chase, VP Sales and Business Development at PV Booster, a manufacturer of rooftop solar trackers for commercial and industrial rooftops.

Holloway is responsible for building and managing relationships with all of SCF’s Developer and EPC Partners. He previously worked at Cobalt Power, a large EPC in Mountain View, California, where he was involved in the origination, development, construction and financing of over 200 solar projects. Chase as well has worked with many commercial clients to help them navigate the commercial solar financing process.

Aurora Solar supports both residential and commercial solar design and sales.

Learn more in a free demo.

In the commercial solar sector, there are a variety of different ways that a project can be financed, but some of the most common are: solar power purchase agreements (PPAs), solar leases, energy services agreements, tax equity financing structures such as sale leasebacks and partnership flips, and cash or loanpurchases of the system. Let’s take a closer look at each.

We’ll start off with PPAs and leases, two of the most prevalent options for financing C&I solar projects. As we explain in our primer on solar financing options,under both PPAs and leases, the PV system is owned by a third-party financier—rather than the solar developer or the customer who will use the power it produces.

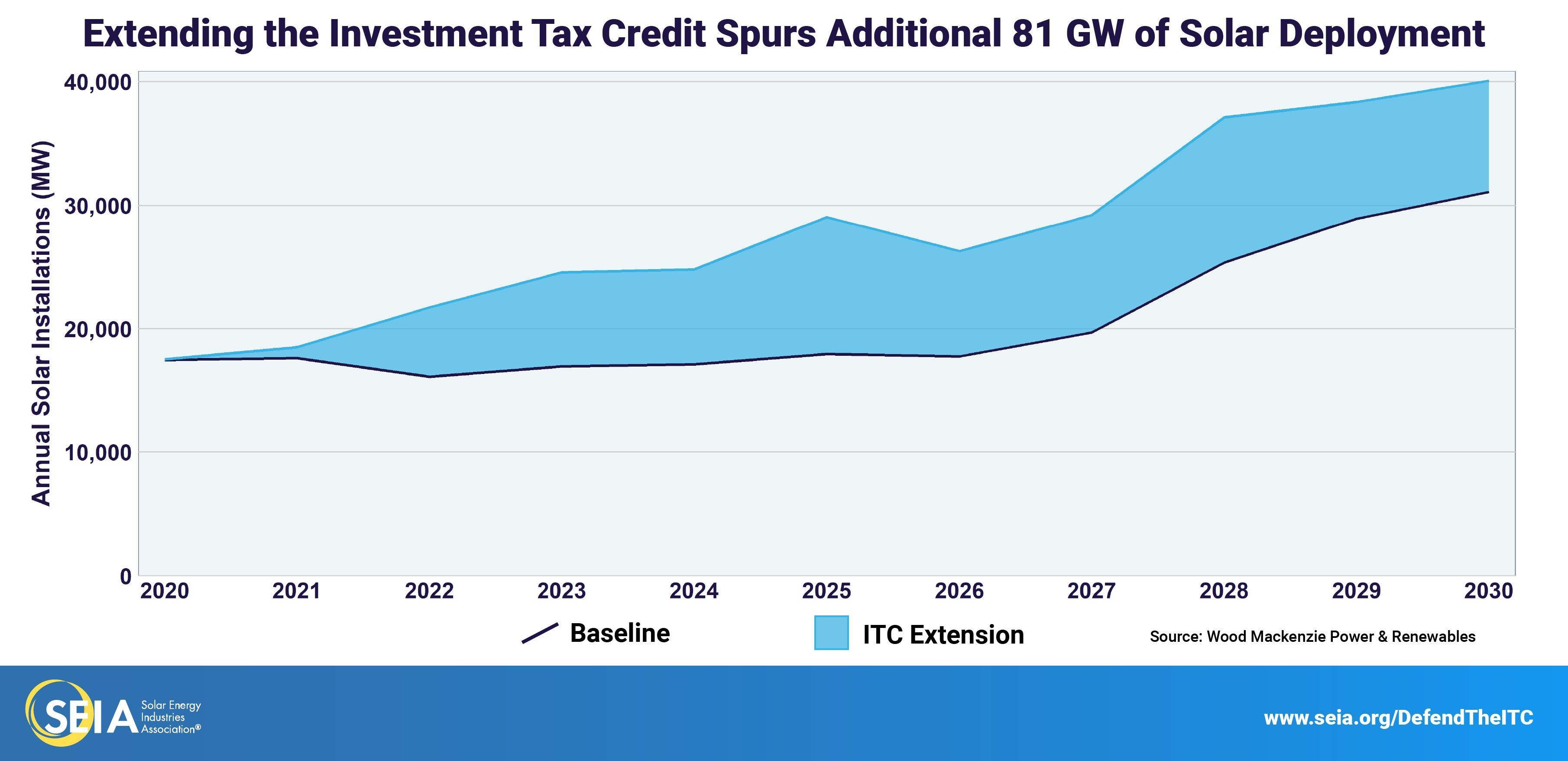

The third-party owner will receive any tax incentives from the system, such as the 30% Federal Investment Tax Credit (ITC) and depreciation. They can pass those savings on to the customer in the rates they offer, making this a preferred option for customers with low or no tax liability (i.e. taxes owed)—such as nonprofits. However, in both leases and PPAs, the commercial customer may be given the option to buy the PV system at certain points during or at the end of the contract.

PPAs

Under the terms of a PPA, the solar customer agrees to purchase the power the solar energy that is produced by the PV system from the system owner at a certain price over a set number of years. The term length of a PPA typically ranges from 10 to 25 years.

A solar power purchase agreement or PPA has historically been one of the dominant ways that commercial solar projects are financed. Holloway notes that, in the commercial and industrial sector, PPAs are “still the primary funding source that I’m aware of.”

And as noted above, the ability for customers without high tax bills to indirectly benefit from another entity taking tax incentives on their behalf is also a big contributor to the popularity of PPAs. “Nonprofits, and other organizations that do not have the ability to take advantage of the Investment Tax Credit—think schools, municipalities, churches, and charities like Boys and Girls Clubs—is in a position where there’s no other way that they can take advantage of the ITC; they need someone to do that on their behalf. And [one of] the only financing vehicle[s] they can use to do that would be a PPA.”

PPAs are popular for other reasons as well. One is that they can be structured so that there is no upfront payment (no money down) required from the customer. Additionally, the long-term nature of some PPAs (e.g. 25 years) can allow for lower payments.

PPAs may also be structured with an escalator—meaning that the price the customer pays for the energy they purchase will increase at a certain rate over time. For customers looking to maximize their savings at the outset, escalators provide a mechanism for lower costs at the start of the contract.

PPA Considerations

If there is an escalator in the agreement, customers should look closely to see how the rate of increase compares to historic rate increases from their utility. While no one can read the future and know exactly how a utility’s rates will increase, it’s important that the escalator is based on reasonable assumptions of future utility rate increases. This minimizes the risk that the customer someday ends up paying more for solar energy than they would have buying power from the grid.

(You can also learn more about our partnership with SCF in this blog post.)

Leases

Leases are another common way of financing commercial solar properties, and they share a number of similarities with PPAs. As with PPAs, the PV system is owned by a third-party financier and the deal can be structured so that there is no upfront payment.

However, instead of purchasing the actual power produced by the system at a per-kWh price as would be the case in a PPA, under a lease the customer pays a fixedrate over a set number of years. While this fixed rate is based on the estimated production of the system and it’s assumed value, the cost that the customer pays is not directly tied to system production.

Whereas under a PPA, the customer’s solar bill will fluctuate seasonally with lower charges when the system produces less, a customer will a solar lease knows that their payments will always be the same. On the one hand, this provides consistency and the ability to plan costs; on the other, if production is lower than anticipated for reasons other than a problem with the system—for instance, during an unusually rainy year—the customers bill will not be proportionally reduced.

Similarly, due to the fixed nature of lease payments, leases do not include escalators as many PPAs do.

Types of Leases: Operating vs. Capital Leases

There are two types of solar leases, with different accounting implications for companies: capital leases and operating leases. While an exploration of the full accounting implications of operating versus capital leases is beyond the scope of this article, a primary difference between the two is that operating leases are not held on the balance sheet of the company, while capital leases are.

As Holloway explains, “Most companies primarily use operating leases in the [C&I solar] space, as capital leases end up on your balance sheet. Most companies prefer to keep as much of their financing off balance sheet as possible for the simple reason that it decreases the amount that they can borrow.”

In essence, an operating lease acts more like renting equipment, whereas a capital lease acts more like a loan and includes some of the benefits and risks of ownership.

Lease Term Length

The length of a solar lease can vary widely, from as few as seven years to as many as 25. However, commercial solar leases are often shorter than commercial solar PPAs. “While it’s possible to offer longer term Operating Leases, this is not currently the industry norm,” says Holloway. “In my experience, the vast majority of operating leases still fall into the 7-10 year term length category.”

The length of the lease will impact how much the customer pays. As Holloway explains, “If you only have seven or 10 years to amortize those payments, those payments are going to be considerably higher” than a longer-term agreement.

Energy Service Agreements

Another type of commercial solar financing that is similar to an operating lease is an Energy Service Agreement. As the American Council for an Energy Efficient Economy explains, “Under an ESA, a service provider delivers energy-saving services using equipment it owns and operates.” Like an operating lease, this is a type of off-balance sheet financing, making it popular with businesses.

While legally distinct from leases, in practice, ESAs are similar to operating leases in that the customer pays a fixed rate for the “service” of solar energy (though ESAs can also be used to finance a variety of other building energy upgrades). In many cases, the ESA provider guarantees a certain level of energy savings.

Chase explains that many companies—especially ones with multiple sites or portfolios of properties—“often use energy service agreements as a no-risk way to finance a number of energy improvements, and essentially receive a guarantee of savings.”

Tax Equity Project Financing: Sale Leasebacks and Partnership Flips

As you can probably tell from our coverage of leases and PPAs above, the “tax equity” of a solar project—or the ability to reduce taxes owed by taking advantage of certain policy incentives like the ITC—is a valuable commodity for entities with high enough tax bills to make use of it.

While tax equity is important in many types of solar financing like PPAs and leases, there are other types of financing agreements that have been developed specifically for the purpose of allowing certain groups with high tax bills (tax equity investors) to utilize the tax equity of a project in exchange for investment.

These tax equity deals are a special category of solar project finance. They includepartnership flips and sale leasebacks, among other structures. While these arrangements are too complex to cover fully in this article, we’ll provide a brief introduction to them and the basics of how they work.

Partnership Flips

In a partnership flip, a deal is structured so that the tax equity investor receives the majority (e.g. 99%) of income allocation of the project for a certain duration of time—specifically until the ITC recapture period has elapsed.. Following that point, the contract specifies that their allocation “flips” such that they can be bought out, or stay in the partnership while being allocated a minority (e.g. 1%) of the project’s income & cash allocations, with the majority then being allocated to the project sponsor.

As Holloway explains, “The tax equity partner’s goal is to monetize virtually all of the tax benefits. Their goal is not to own the asset for the long term… [just to] be a partner in the deal until the benefits of the tax equity—the ITC, depreciation, etc.—have been monetized.”

“At that point the tax equity partner “flips” out of the deal; they go from being [for example] a 99% income allocation partner to 1%. Then the sponsor has a 99% allocation, and they are in it for the long haul.”

A partnership flip is one of the most common forms of tax equity financing in solar.

See how Aurora helps solar companies design and sell better solar

Sale Leasebacks

In a sale leaseback, the tax equity investor purchases the PV system from the project sponsor. They then lease the system back to the project sponsor who retains the right to use and operate the system and receive revenue through its operation. The sponsor has the option to purchase the system at some point.

Transaction Costs Impact the Use of These Financing Options

Solar project finance deals like these bring together several parties with different interests and goals in a project. Negotiating legal terms that are acceptable to all can be costly. As Chase explains, “because there are so many parties involved, there are high transaction costs to securing this type of finance.”

These high costs typically mean that such deals only make sense for large projects above a certain value. In addition to the large commercial sector, these types of finance structures are well established in utility scale; however, they are impractical for many smaller commercial projects.

Debt Financing (Loans)

In addition to the variety of financing options discussed above, in which ownership of the PV system is held by someone other than the user of the solar energy (at least for a period of time), a commercial solar customer can choose to purchase their PV system—outright (cash) or through a loan.

In these cases, the tax benefits go to the customer. Since cash deals are straightforward, we’ll restrict our discussion to loans. Solar loans are similar in many ways to other types of loans that you may be familiar with in your daily life.

Types of Debt Financing

There are multiple types of loans, including secured loans, which are “secured” by the lessee’s assets, and unsecured loans, which are not. For customers comfortable using their assets—like their real estate property—as collateral, secured loans can enable customers to get a better rate or to get a loan that they might not otherwise qualify for. To do that, the customer must own their building.

Additionally, another form of debt financing that has emerged in some areas is Property Assessed Clean Energy (PACE) financing. In PACE financing, the loan for the solar installation (or other property improvements, like energy efficiency upgrades) are repaid in the property taxes of the project site. PACE is only available in areas that have enabling legislation, but can be another good option of financing solar—particularly since in some cases the loan can be repaid over as many as 30 years.

Debt Financing Considerations

A key limitation when comes to solar loans is whether the project owner (commercial customer) has strong enough credit to get a rate that makes this option financially feasible—or to get a loan at all. For large companies this may be straightforward, but for others, especially small businesses, it can be a challenge.

Chase explains why asset-backed lending can be a good option for some customers. “Say your commercial solar customer is a building owner—a family business that’s been around for 20 years and they don’t have investment grade credit. They still may qualify for a loan, but they may have to have a very high interest rate. Ultimately, they may determine it’s not worth it, depending on how much they’re saving.”

“The benefit of PACE or a real estate loan is that their credit rating is not an issue because the loan is backed by the actual asset value of the property. That directly opens up project financing for solar and other energy upgrades to a whole group of customers that didn’t have access before.”

Of course, whether this option is a fit depends on the goals of the commercial property owner. For instance, the lower borrowing rates of a real estate-backed loan may be appealing companies that plan to own the project site for the long-term—particularly if the solar project increases the value of their property. However, it would make less sense for a customer interested in selling their property.

As you can likely tell, commercial solar finance can be complex! In this article we’ve only scratched the surface of the details of each of these common solar financing methods: solar PPAs, solar leases, energy service agreements, tax equity financing structures including but not limited to sale leasebacks and partnership flips, and debt financing.

Depending on the role your solar company takes in C&I solar projects, you don’t need to be an expert in these kinds of solar financing mechanisms. However, it is important to understand the diverse financing options available and their implications. This will let you guide your commercial customer in understanding what options may be available to them and what questions they may want to ask.

Determining how to pay for the system is a critical first step to closing the sale, so the more you can do to help your commercial customer navigate this (sometimes daunting) process, the more likely you’ll be able win commercial solar business.

.png)

A blockchain contains bundles of transactions called “blocks.” Once added to the chain, the transaction ledger in a block cannot be changed, creating a consistent version of events for all users in the network.

A blockchain contains bundles of transactions called “blocks.” Once added to the chain, the transaction ledger in a block cannot be changed, creating a consistent version of events for all users in the network.

Blockchain can facilitate peer-to-peer energy trading. This could enable solar energy producers to provide energy to consumers in their local community.

Blockchain can facilitate peer-to-peer energy trading. This could enable solar energy producers to provide energy to consumers in their local community.

The Urgent Climate Crisis

The Urgent Climate Crisis